Natural Gas – Understanding the Commodity

A look at the global trade in natural gas and why this commodity has become so important in today’s financial markets.

Natural gas is a fuel that is used extensively all over the world to provide heating for homes, as well as to supply fuel for a variety of commercial and industrial applications. It shares many similarities with bio-gas, which is the gas produced when organic matter is broken down.

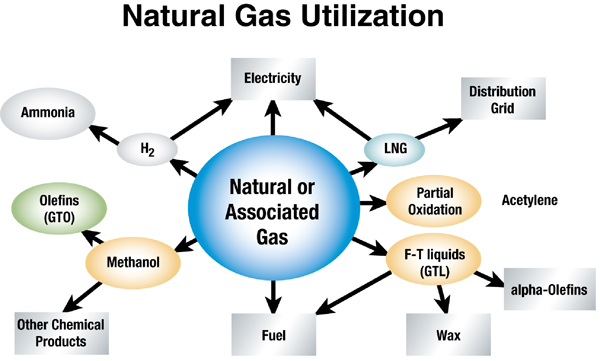

Because natural gas is a fossil fuel, it has many impurities which need to be removed in order to produce commercially viable methane gas. Some of the secondary products that are extracted include helium, ethane, butane, hydrogen sulfide and propane; these provide a secondary source of income for the refiners.

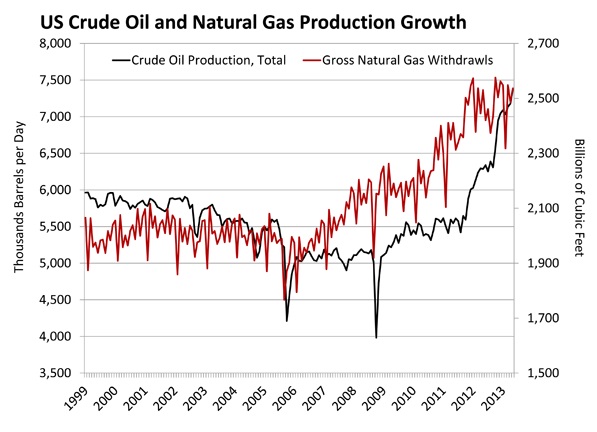

Natural gas was once considered a waste product of the oil production, but it is increasingly finding prominence in today’s world. Efficient, friendly to the environment and economical, it is the cleanest burning of all fossil fuels. New technologies are also being constantly developed to improve how natural gas is extracted, transported and distributed.

In this article, we will look at this important commodity and analyze some of the factors that affect its supply, demand and price.

The Effects of Weather Conditions

Bad weather, including hurricanes, tropical storms and gales can significantly affect the production of natural gas. This side factor of supply often forces refineries into slowing down their production, or to even shut down completely, in efforts to prevent bad weather from posing a threat to their workers or facilities.

For example, a series of hurricanes experienced along the Gulf Coast during the mid-2000s, caused gas companies operating in the region to close down their domestic operations for almost a year. This slowdown in production resulted in the country losing about 4 percent of the expected output of natural gas during that period.

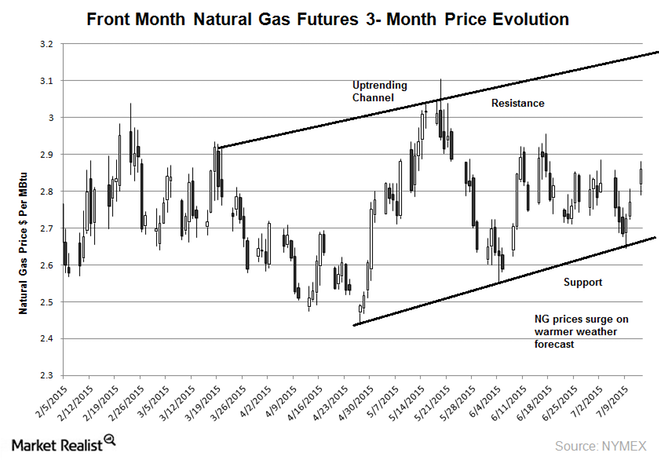

When weather effects like tornadoes or blizzards affect travel, it also impacts the prices of natural gas because the delays in the delivery of natural gas cause an artificial shortage of the commodity. When there are milder conditions during times of the year when use of natural gas are traditionally high – fall and winter – prices drop lower because consumers do not use their home heating systems as much as they usually do.

Economic Growth in Gas-Reliant Economies

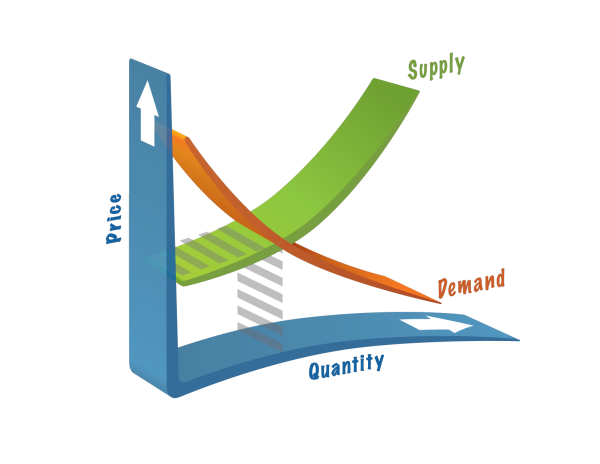

As an economy grows, the price of natural gas increases. This is because in an economy with good growth figures – especially in the industrial and commercial sectors – there is a spike in the demand for this resource. Companies that operate in such an economy experience increased demand for the goods and services they provide. This, in turn, increases the levels of demand for fuel sources, including natural gas.

As more sectors of the economy demand natural gas, the price of the commodity rises. More industries require this resource and its associated byproducts than most consumers realize. With this demand, natural gas has become a popular commodity to trade on in the financial markets and in addition, many leading binary options platforms, also offer trade in this commodity.

Fluctuations in the Price of Crude Oil

As a trader, it is vital to understand that the price of crude oil influences the price of natural gas and its uses in a way that traditional fossil fuels, such as coal and home heating oil, do not. Whenever the cost of crude oil goes up, the cost of associated products offered by refineries, including gasoline, rises as well. Rising gasoline prices mean that many consumers have to make changes to their buying strategies and travel plans. They spend less than they would normally do, take shorter trips and go on fewer vacations.

Businesses that rely on petroleum often also cut down on their fuel usage to reduce their overheads. In such a case, natural gas can be an attractive alternative since many of the machines that operate with petroleum as their fuel can also run on natural gas. High demand for crude oil results in increased costs of production. This causes a hike in the prices of both crude oil and natural gas.

Competition among Different Forms of Fuel

The use of natural resources by industrial operations and energy producers often changes with their availability and price. As a rule, these companies seek to take advantage of the most affordable source of natural fuel as a way to control their costs of production. Because the fuel markets – coal, oil and natural gas – are of an inter-related nature, any increase in interest in favor of any one, will drive down the prices of the others. For instance, if electricity companies produce more of their power by burning coal, it will reduce the demand for oil and natural gas. Their price will then drop, as their demand falls. Because of the economies of scale at play, even small increases or decreases in the price of a type of fuel, have noticeable effects on that particular fuel’s demand.

As a trader, understanding the effects of external factors on the price of commodities is vital in order to trade accurately. Leading brokers, such as Option.FM, provide their traders with access to detailed market analysis and market news in order to enable them to understand the future price movement of different assets.

Trading Natural Gas on the Financial Market

For a long time, trading in natural gas on various markets has been the main way that investors are exposed to the commodity. Although it is possible to take advantage of the trade through the stock market or ETFs, many investors prefer the more direct and liquid option of purchasing futures contracts and their derivatives.

For US exposure, there are few starting points that are better than the New York Mercantile Exchange or NYMEX. This exchange gives traders the chance to profit on a variety of contract types and to buy Henry Hub futures options. Another advantage of NYMEX is that the contracts are available to investors all through the year.

An additional choice available to investors is the Intercontinental Exchange (ICE). It offers both the Dutch-based Title Transfer Facility (TTF) futures as well as UK natural gas contracts. These two contract types give traders a more global outlook on trading this commodity.

Another option for non-US investment in natural gas is through the Multi Commodity Exchange (MCX) based in India. With contracts available all year, the smaller contract values make this a better fit for investors who have a lower capital base but who are looking for exposure to this commodity.

For binary options traders, natural gas is a commodity which can also be traded on some online trading platforms. Since a trader is not actually purchasing this commodity but simply making a prediction regarding the direction that the price of the asset will move within a predefined time, this form of online trading has enabled investors worldwide to get the opportunity to trade natural gas and to profit irrespective of if the price of the commodity rises or falls.